Manufacturing Overhead Is Best Described as

All period costs associated with manufacturing operations. Indirect materials and indirect labor.

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

In the year-end financial statements the.

. Under variable costing fixed manufacturing overhead costs are best described as a. The over or under-applied manufacturing overhead is defined as the difference between manufacturing overhead cost applied to work in process and manufacturing overhead cost actually incurred by the entity during the period. Manufacturing overhead also known as factory overhead factory burden production overhead involves a companys manufacturing operations.

C costs that are not economically feasible to trace directly to specific jobs or processes. Supplies not directly associated with products such as manufacturing forms Since direct materials and. All manufacturing costs other than direct materials and direct labor.

D costs that management has decided not to trace directly to specific jobs or. Manufacturing overhead is best described as. All operating expenses other than selling expenses and general and administrative expenses.

Correct All period costs associated with manufacturing operations. The sum of raw materials costs and direct labor costs. Manufacturing overhead is all indirect costs incurred during the production process.

Manufacturing overhead is best described as. The method of inventory costing in which direct manufacturing costs and manufacturing overhead costs both variable and fixed a. Manufacturing costs are also known as product costs.

All manufacturing costs other than direct materials and direct labor. The method of inventory costing in which direct manufacturing costs and manufacturing overhead costs both variable and fixed are considered as inventoriable costs is best described as. Using absorption costing fixed manufacturing overhead costs are best described as.

Manufacturing overhead is best described as. All costs associated with manufacturing other than direct labor costs and raw material costs. All period costs associated with manufacturing operations.

A costs that cannot be traced directly to specific jobs or processes. Manufacturing overhead is best described as. Direct material 25 direct labor 30 fixed manufacture overhead 45 variable manufacture overhead 15 Using absorption costing fixed manufacturing overhead costs are best described as.

Manufacturing overhead is best described as. Fixed manufacturing overhead costs were P20000 and variable manufacturing overhead costs were P3 per unit. Are variable costs B.

All period costs associated with manufacturing operations. Direct materials direct labor factory overhead and administrative overhead. Manufacturing costs incurred to produce units of output.

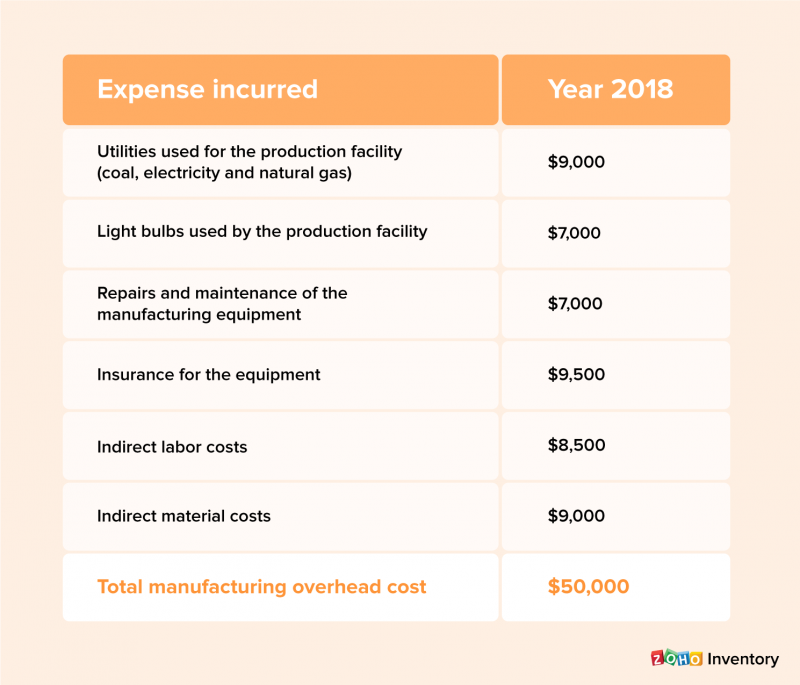

It includes the costs incurred in the manufacturing facilities other than the costs of direct materials and direct labor. Examples of costs that are included in the manufacturing overhead category are as follows. Manufacturing overhead is best described as.

Multiple Choice All manufacturing costs other than direct materials and direct labor. Using absorption costing fixed manufacturing overhead costs are best described as indirect product cost. Direct materials and direct labor only.

All operating expenses other than selling expenses and general and administrative expenses. The sum of direct labor costs and all factory overhead costs. Indirect period costs d.

Are anticipated future costs that will differ among various alternatives c. All operating expenses other than. Using absorption costing manufacturing overhead costs are best described as A.

Using absorption costing fixed manufacturing overhead costs are best described as. Manufacturing overhead is best described as. Manufacturing overhead is best described as.

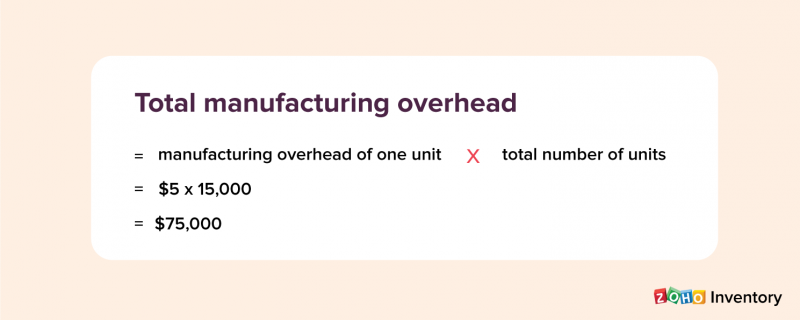

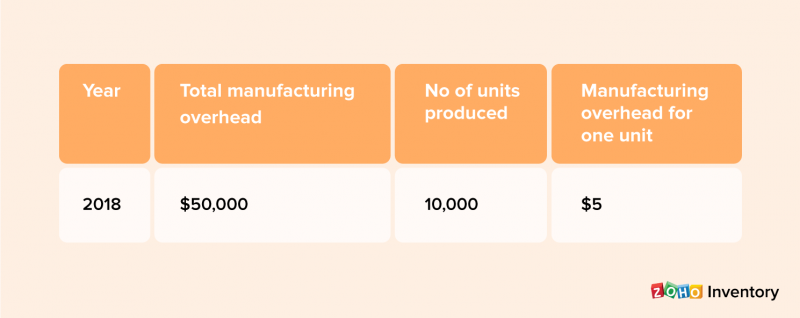

This overhead is applied to the units produced within a reporting period. Which method treat direct manufacture cost and manufacture overhead cost both fixed and variable as inventoriable cost. Direct period costs c.

Under absorption costing fixed manufacturing overhead costs are best described as 11 Direct period costs Indirect period costs Direct product costs Indirect product costs Black Company produced 10000 units and sold 9000 units. If the manufacturing overhead cost applied to work in process is more than the manufacturing overhead cost actually incurred during a. All manufacturing costs other than direct materials and direct labor.

Are the differences in costs between any two alternative coursesnof action. Indirect materials and indirect labor. Which of the following best describes those costs which are considered to be manufacturing costs.

B All period costs associated with manufacturing operations. Indirect materials and indirect labor. Hence manufacturing overhead is referred to as an indirect cost.

Direct product costs b. A All manufacturing costs other than direct materials and direct labor. It is indirect because it is not directly traceable to a specific unit and a product cost because it allocated to the product.

In the year-end financial statements the. B costs that are economically feasible to trace directly to specific jobs or processes. Under absorption costing fixed manufacturing overhead is allocated to the units produced and it is best classified as an indirect product cost.

Direct materials direct labor and factory overhead. Multiple Choice All manufacturing costs other than direct materials and direct labor. Indirect materials and indirect labor.

Re considered as inventoriable costs is best described as. All manufacturing costs other than direct materials and direct labor.

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Fixed Manufacturing Overhead Variance Analysis Accounting For Managers

No comments for "Manufacturing Overhead Is Best Described as"

Post a Comment